The real-estate market European expects more and better of face to 2014

Source: Price WaterhouseCooper

03/03/2014The European economy is growing and the political uncertainty on his future reduces . Ireland seems that it improves and in the south of Europe all aims to that has been over the worst. The capital flows to the continent and results easier to find financials via debt; although this last depends to a large extent of where and for what require the financials. These are some of the feelings collected in the Real-estate Market trends – Europe elaborated by Price WaterhouseCooper. To continuation publish a summary of said report, that can find whole in the

The risk has left to be an earthy word. To measure that improves the European economy, the real-estate sector seems is going out of the bunker in which it had put and adentra in fields that does so only a year would have considered intransitables. Capital of all the world are flowing to Europe and intensifies the competition by the best buildings in the best locations of the designated ‘gateway cities', this is, the cities that serve of entrance to the country to a lot of foreign citizens. It has arrived the moment to look further of the obvious and centre the looks in other markets in where the prices and the dimensions of the existent batches are easier to digest. And what is also important is that it begins to be available the financials via debt for these active.

The change of attitude more impactante of all is the disposal of the sector to contemplate investments in the south of Europe and, in particular, in Spain. The past year, Real-estate Market trends - Europe cataloged to Spain like a market to watch, but the transition of “not investing” to “good opportunity” has been surprisingly fast.

Now well, the real-estate sector European keeps his abstemiousness. The existent dichotomy between ‘assuming more risk' and ‘the first, the hygiene' does patent in the punctuations awarded by the respondents of Real-estate Market trends - Europe in his perspectives for 2014. Munich situates in first position in the category of existent investments, followed of Dublin. Likewise, Dublin occupies the first place in the category of new investments, whereas Madrid, Barcelona and Athens, that situated in the last places of the classification of perspectives of the past year, situate in 2014 in half of the table. And, curiously, to measure that Europe leaves backwards the recession, the environingingmental priorities go back to surface like a significant factor of the investment.

This year, for the first time, Real-estate Market trends - Europe has formulated to the sector a series of direct questions on questions of sustainability. And the answers were of the more reveladoras: three of each four respondents includes the sustainability like integral factor of his strategy of business.

Some of these questions of sustainability base in the push promoted by the increase of the regulation. But also it exists a factor of demand in this regard: the companies see that the sustainability has a solid business logic, when mitigating the obsolescence and attract tenants and capital.

In the real-estate market 2.0 the success will not depend only of the election of the active suitable and of his optimum management, but also to know identify what moves to the market – demographic appearances, regulation, technologies in constant change and lifestyles that evolve.– As it indicates one of the interviewed of the report of this year, “the catchment of value does not depend only of the brick, also is necessary to comprise the function of the active real-estate”.

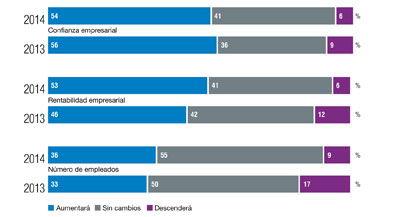

The real-estate business in 2014. (It is possible that the percentages do not add 100 because of the round). Source: Real-estate Market trends - Europe 2014.

The battle by the active

To measure that the investors have gone increasing his investments in the real-estate market, has produced “enormous impulse” of the capital that has gone to stop to the markets ‘core' European, and that will continue during 2014. The consequences of this impulse are multiple and very miscellaneous.

The interviewed and the respondents quoted expressesions like “bubbles of prices” and “overheating of the markets” that are definitely own of the previous period to the financial crisis. For some this is a symptom of worry and for others is an opportunity. “We have seen how they have gone up the prices and think that still have something of route, but sooner or later the markets will leave to have sense. Determinate markets, like London and Germany, are beginning to arrive to a critical point”, affirms the representative of an entity of credit. “Some of the pertinent investors of United States and Asia are investing in batches of active of big dimensions in markets to which possibly have not devoted them too much time. Always they produce errors of calculation when there are so many investors in search of an offer limited of active”.

The forecast elaborated by an international quality consultancy regarding the value of the active prevail of the market paneuropeo in 2014 situates in a growth more sobrio of 4% in the case of the offices, of 1% in the industrial segment and of 4% for the commercial venues.

Capital to streams

The direct investment in the real-estate sector European finds “practically in the previous levels to the crisis” and this impetus can attribute especially to the entrance of pertinent capital of the sovereign bottoms, mainly pertinent of Asia. So much the interviewed like the respondents in the frame of the manufacturing of the report manifested with total rotundity that the sovereign bottoms follow keeping his command through the flows of capital that allocate fundamentally to active core. “We are optimistic” regarding the fact that these new sources of capital (big part of which are pertinent savings of the emergent markets in where they have achieved a good performance) see forced to diversify and to invest abroad”, affirms one of the interviewed.

“There is an enormous volume of pertinent capital of Asia that is going in in Europe”, affirms an agent of bottoms paneuropeos, “and although you only achieve to attract a small part of this capital, in reality are you carrying a volume of money very significant like agent of bottoms”.

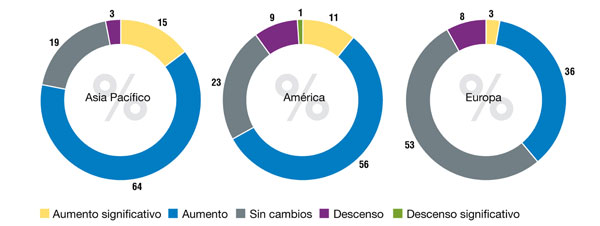

Almost 80% of the respondents thinks that the pertinent capital of Asia Pacífico will increase during 2014. The another big source of capital proceeds of America and, in this case two third parts of the respondents foresee that it produce a significant increase of the pertinent financials of this region in 2014.

Exist positive indications that this strengthening of the flows of international capital has encouraged also to the national entities, especially in the United Kingdom, that keeps on being the market investor bigger and of greater liquidity of Europe.

Gone in of international flow of capitals to the real-estate market European in 2014. Source: Real-estate Market trends - Europe 2014.

Next unemployed... Spain

The feeling investor to Spain has given an extraordinarily positive twist, turning into one of the most stood out appearances of the report of this year. To the few weeks that the Sareb, the designated bad bank constituted in this country, began to operate the past summer, the arrival of opportunist investors to Madrid and Barcelona turned into an authentic stampede. For autumn, the transformation of the real-estate market Spanish, happening to be the ‘black sheep' to the ‘market crashes' European, already had consummated . Everything aims to that this renaissance will continue by the same senda during 2014.

“Equal that sucedió with Ireland, 24 months ago anybody wanted to know at all in this regard. And now it has turned into the most wished market of the sector”, affirms one of the interviewed. “There is an excessive volume of capital in search of a limited offer of products in Ireland and therefore also it will recover the Spanish market, because all the investors that before were operating in Ireland now have put his look in Madrid”.

One of the agents of bottoms paneuropeos interviewed considers that, sooner or later, the traditional institutional investors will begin also to compete with the opportunist investors in Spain. “We think that they will be processes to half term and no so many immediate investments, but the investments will arrive. Probably we will see one or two big operations that will give confidence to other investors to launch to the best active situated in the best emplazamientos”.

However, also there are a lot of dissonant voices that think that Spain keeps on being a market ‘distressed' and is far to be something more sustainable. Although it is true that the volume of investment for the three first quarters of 2013 shot in 198% (according to data of Real Capital Analytics) also is truth that split of a very low base —the total situated in so only 2.400 million euros—. Meanwhile, the financials via debt keeps on being extremely complicated to achieve in Spain.

The more sceptics also aim that the existent disconnection between the flows of capital and the demand of occupation of tenants and the growth of the rents results more extreme in this country that in any another of Europe. “It keeps on being a dangerous market in which invest a high volume of money until we do not see some indications of growth, and by the moment, the situation keeps on being quite a lot of anaemic”.

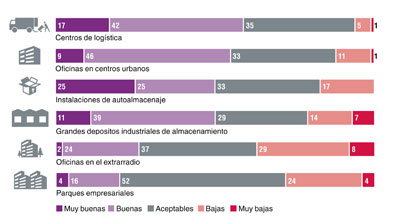

Perspectives of investment in the real-estate sector 2014. (It is possible that the percentages do not add 100 because of the round). Source: Real-estate Market trends - Europe 2014.

The resurgir Spanish

But the main disclosure is the movement of capitals that is going in in Spain, that has happened to be a “investment desaconsejable” to turn into the ‘market crashes' overnight. It does not treat so much of a research of value but rather that ‘all the world is doing it and no want to it to you lose', as they indicate some of the most skeptical respondents.

The investors have shaken of the possible fears to a split of the zone euro and have attended with strength to Madrid and Barcelona, once created the Sareb, the designated bad bank, in summer of 2013. For a lot of investors, treats to go back to do the done in Ireland with the National Asset Management Agency. “It treats to take advantage of the opportunities that begin to open once that the banking sector begins to take out to the light his wallets and problematic loans” affirms one of the interviewed. “The difference with Spain is that this transition has produced very quickly”.

The sustainability matters

The business logic of the sustainable real-estate investments is beginning to calar in the sector, six years after the start of the financial crisis. More than three fourth parts of the respondents have of a strategy of sustainability that does not limit only to fulfil with the national and community rules. In the back market to the crisis exists an every time greater recognition that the green real-estate ‘investments' form part of the designated ‘consolidation of the quality' and, therefore, constitute a diferenciador key of face to the potential tenants. “The sustainability will have an every time greater importance so much to the hour to achieve tenants that decide to engage with a real estate during a period of greater time and also of face to the final value of the investment”, affirms the CEO of a global signature of investment.

The half of the respondents of Real-estate Market trends – Europe considers that this tendency to the investment in active sustainable has allowed them achieve some higher rents, which constitutes definitely one of the most extraordinary results of the report, and something difficult to expect in previous years.

Even those that follow without being convinced that it exists a narrow correlation between sustainability and high rents, recognise that the greenest ‘buildings' offer a greater protection in front of the obsolescence, to the time that keep controlled the operative costs.

In any case, the opinion generalised between the interviewed and respondents is that the investors and the promoters infraestiman, assuming the risk, the possibilities that offers them the sustainability.

Markets in the sight

The recovery already is under way, and the investments go back. This is the message that is launching the real-estate sector European this year.

The optimism has gone back and foresees that the perspectives of the distinct cities of face to 2014 improve considerably, which indicates that the investors are giving off of his worries about the economy.

One of the most surprising recoveries of the report in the classification of this year stars it Spain, and in particular Madrid and Barcelona. The interviewed choose the south of Europe like the place preferred in which invest, and Spain benefits of the dimensions of his market and of the forecasts that aim to that it will be the first country of the south region European in attaining a consolidation of his recovery. In particular, the opportunist bottoms are centring in Madrid and Barcelona, and expects that the corporate operations abound in 2014, especially to measure that the Sareb, the bad bank constituted in Spain, put new active real-estate and new on sale loans. The investors ‘core' can that they show more reluctant to go in in a market like east, but beyond all doubt the conversations already have initiated

The cities

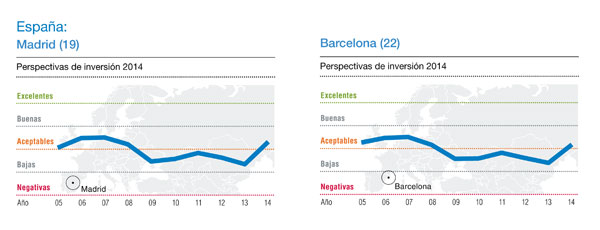

Every year, Real-estate Market trends – Europe analyses the real-estate markets of the main European cities and classifies them with arrangement to his perspectives of investment. This section shows how have evolved the perspectives of investment with the step of the time, in base to the proportionate answers by the respondents of the report. The number that appears between bracket beside the name of the city corresponds with his place in the ranking of existent investments in 2014, whereas the chart shows the evolution of the perspectives of face to new and existent investments from 2005.

- • Madrid (19) / Barcelona (22)

Spain has gone back to the market. That is the message that launch the consulted by the report Real-estate Market trends – Europe. “All the world opted for leaving the towel in the beach this past month of August and decided that Madrid and Barcelona was where had to be”. Madrid has escalado positions in the category of new investments to the time that expects the entrance of new capitals during 2014. “The prices are reaching already his floor, and the upward potential is evident. It treats of a market of big dimensions and is the capital of a country of more than 40 million people”. Barcelona, by his part does not find too far and situates in the put number 14.

Perspectives of investment 2014. Source: Real-estate Market trends - Europe 2014.