Entrevista a Aniceto Zaragoza, director general de Oficemen

Como elemento clave en la obra pública y en la construcción, conocer la evolución que viene siguiendo la producción y el consumo de cemento en nuestro país durante los últimos años nos puede dibujar un retrato muy aproximado de la situación que atraviesa este sector. Para ello, en Interempresas, hemos tenido la oportunidad de entrevistar a Aniceto Zaragoza, director general de Oficemen, la Agrupación que reúne a los fabricantes de cemento en España.

Según los últimos datos que han aportado desde Oficemen, el consumo de cemento en España cerró el 2013 con una caída del 19%. ¿Considera que ya se ha tocado fondo?

Lamentablemente, no. Después de la caída en 2013, que ha situado el consumo total de cemento por debajo de los 11 millones de toneladas, las previsiones para 2014 no son más alentadoras. Las cifras esperables de inversión pública y la paralización en que sigue inmerso el sector inmobiliario avalan una nueva caída que oscilará entre un 7 y un 8%. Si nuestras previsiones son acertadas, el mercado doméstico cerraría el año 2014 en unos 10 millones de toneladas.

De momento, el consumo de cemento en España ha caído de nuevo en enero un 13,6%. El año se ha iniciado por tanto, sin indicios de recuperación en el sector y con un porcentaje de caída peor al previsto, ya que duplica al esperado para el conjunto del año por Oficemen.

¿Supone este 19% la mayor caída desde el inicio de la crisis? ¿Cuál es el descenso acumulado tanto en producción como en consumo de cemento en España?

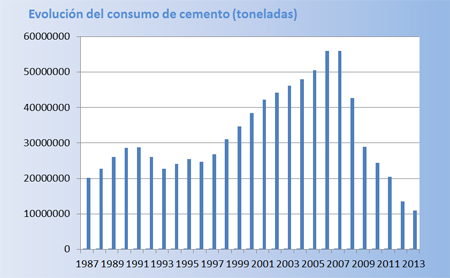

Desde el inicio de la crisis se han ido sucediendo caídas consecutivas de dos dígitos hasta acumular un descenso total, en los últimos seis años, de un 80%. La mayor caída porcentual se produjo al cierre de 2012, con un 34%, lo que supuso en su momento el mayor descenso porcentual sufrido por el mercado doméstico español en su historia reciente. Habría que remontarse a 1936 para encontrar una caída mayor.

En términos absolutos, el mercado doméstico español ha pasado de consumir casi 56 millones de toneladas en 2007, a menos de 11 en 2013.

¿Cómo se refleja este desplome en pérdidas de puestos de trabajo y en masa empresarial?

Mientras que el mercado doméstico ha caído en torno a un 80%, el empleo sólo lo ha hecho un 43% en el mismo período. Tan solo dos fábricas se han cerrado desde el inicio de la crisis. La industria cementera se ha caracterizado siempre por ser un sector con empleo estable y cualificado, en el que empresarios y sindicatos mantienen una estrecha colaboración aunando esfuerzos, siempre con el objetivo de alcanzar una estabilidad sectorial.

No obstante, el sector está pasando por momentos de ajuste duros, ya que como media las fábricas radicadas en nuestro país solo están trabajando al 40% de su capacidad productiva instalada.

¿Hay algún precedente en la historia de nuestro país en el que se acabara el año con un consumo de cemento inferior a las 11 millones de toneladas?

Las cifras de consumo anual actuales son similares a las que tenía nuestro país a mediados de la década de los años sesenta del pasado siglo. No obstante, el indicador macroeconómico más fiable para establecer una comparativa es el dato de consumo per cápita, que permite comparar las cifras teniendo en cuenta el volumen de población que consume el cemento. En ese contexto, el consumo per cápita más similar al alcanzado en 2013 es el del año 1962, que rondaba los 220 kg/hab.

Tras esta fuerte caída del mercado, ¿en qué niveles se mueve España respecto a otros países europeos?

Basándonos en el consumo per cápita, únicamente Reino Unido (153 kg/hab/año), Grecia (221 kg/hab/año) y Holanda (263 kg/hab/año) tuvieron un consumo per cápita inferior al de España en 2012 (según los últimos datos disponibles para el total UE-27).

De la producción actual de cemento en España, ¿qué porcentaje se destina a la exportación?

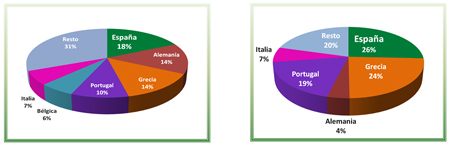

En 2013, España exportó 6,7 millones de toneladas, un 8% más que en 2012, lo que supone casi un 40% del cemento producido en nuestro país. En la actualidad, España es el primer exportador de cemento de la UE, representando el 18% de las exportaciones totales comunitarias y casi el 26% de las no comunitarias.

¿Cuál ha sido la evolución de este reparto (nacional/exportación) desde el inicio de la crisis?

En los años de mayor bonanza económica, a mediados de la década de 2000, España llegó a ser el primer consumidor de cemento de la UE, con una cuota del 22,6% sobre el total europeo y con unos niveles de consumo per cápita de 1.278 kg/habitante. Así, y aun teniendo todas las fábricas trabajando al 100% de su capacidad instalada, el sector recurría a las importaciones como consecuencia de la imposibilidad de absorber la gran demanda internada del mercado español. España se situaba pues, en el año 2006, a la cabeza de los importadores de cemento a nivel europeo.

¿Cuáles son las principales fortalezas de nuestro cemento en el mercado internacional?

¿Y las principales barreras para su exportación?

Por desgracia, en los últimos años, el coste energético en general y el eléctrico en particular han elevado los costes de producción respecto a los de otros países del entorno, restando competitividad y ralentizando las ventas en los mercados internacionales.

En concreto, ¿cómo afecta al sector estos vaivenes que se están produciendo en nuestro país en materia de política energética?

Como decía, el encarecimiento imparable del coste final eléctrico en España ha sido el principal escollo para aumentar las exportaciones. Es un mercado muy maduro y competitivo, donde cualquier oscilación en los costes puede provocar la pérdida inmediata de un mercado, de ahí la ralentización de últimos meses.

Los consumidores industriales electro-intensivos, como es el caso de la industria española del cemento, necesitan un precio final de la energía eléctrica competitivo frente a los que tienen sus competidores en otros países de su entorno y, sobre todo, más estables, lo que permitiría contemplarlos en el medio y largo plazo.

De cara al futuro, ¿qué previsiones tienen desde Oficemen para los próximos años?

Más difícil resulta aún saber cuándo podremos hablar realmente de recuperación, un concepto condicionado al retorno de los niveles de consumo propios de un país industrializado como España, que, dado el volumen de población y la superficie, deberían rondar los 20 o 25 millones de toneladas anuales.

Y dentro del marco general, ¿en qué sector tienen puestas mayores expectativas de recuperación: edificación residencial, no residencial u obra pública/civil?

El primer paso para que pueda recuperarse cualquiera de estos subsectores es que vuelva a fluir el crédito, lo que a su vez activaría otras variables como el empleo, el consumo y la vivienda. Todo ello redundaría, finalmente, en una recuperación de la inversión pública.

Ahora que habla de la inversión pública, lo cierto es que en los últimos años, la dotación de los Presupuestos Generales del Estado para la inversión en infraestructuras no ha parado de bajar (-8,6% en 2014, -13,5% en 2013, -28,1% en 2012 y -35,1% en 2011). ¿Puede permitirse realmente España esta tendencia?

Desde Oficemen no nos cansamos de repetir que, de continuar con esta tendencia, nuestras infraestructuras perderán el tren de nuestros vecinos europeos y con ellas, el conjunto de la industria. El Programa de Estabilidad del Reino de España para el periodo 2013-2016 prolonga la restricción de la inversión pública, estimándose un volumen medio de licitación anual de entre 4.000 y 5.000 M€, una quinta parte del volumen licitado en el año 2010. Este plan ha situado la inversión pública en su volumen histórico menor y nos separará definitivamente de nuestros socios europeos que en los próximos años seguirán aumentando la inversión a buen ritmo.

Por todo lo que Ud. ha señalado en esta entrevista, parece evidente que no puede haber recuperación en España sin tener en cuenta a la construcción. ¿No es así?

Efectivamente. Aunque en los años de crisis se ha extendido entre la opinión pública, la creencia de que en España se ha construido en exceso y ya no queda nada por hacer, esta afirmación, no por repetida, ha pasado a ser cierta. Lo cierto es que la inversión pública española en las dos últimas décadas dista mucho de ser anormal ya que se situó en valores similares en relación al PIB a los de Luxemburgo, Holanda, Francia o Suecia. Lo que sí podríamos calificar de anormal es la situación vivida desde 2009, que ha situado la inversión pública en el mínimo histórico de la base estadística (desde 1964) con un 1,3% del PIB.

¿No es injusto culpar a este sector de los grandes males del país?

En nuestro país –aeropuertos sin aviones al margen- hay un buen número de infraestructuras que están lejos de las mejores prácticas europeas. Son las ‘infraestructuras discretas’ entre las que podemos incluir la eliminación de los cuellos de botella en los accesos a las grandes ciudades, la supresión de trazados antiguos en nuestras carreteras, las conexiones ferroviarias con Europa, las redes de saneamiento y estaciones de depuración de poblaciones pequeñas y medianas, el abastecimiento hidráulico de zonas áridas de España, las mejoras en las redes logísticas… todas ellas imprescindibles para el correcto desarrollo económico e industrial de cualquier país.