The Spanish industry of moulds shows symptoms of recovery

Some figures to define the general situation

In the table of Anaip (table 1) reproduced can observe that the production of transformed plastics the 2011 has diminished 4,6% in relation to the 2010 and 23,7% in relation to the 2007. But the backstitch of 5% of the 2010 has not had continuity in the 2011. It is necessary to take into account besides that for moulds and matrices, Feamm has of official data (INE, Icex) until the 2010.

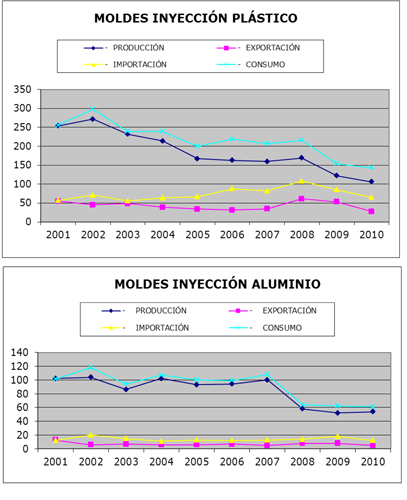

In the corresponding table (2) can observe that the production of moulds of injection of plastic is falling from the 2001 having situated in the 2010 in 106 million euros, 58% underneath of the 254 of the 2001. Something seemed occurs with the ones of injection of aluminium that have happened of 102 to 54 millions.

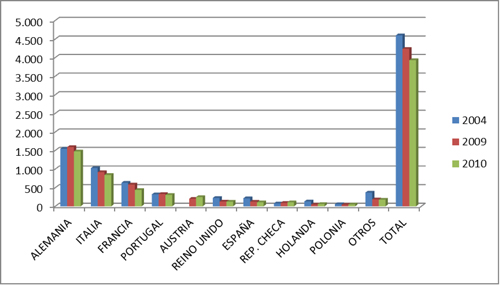

In Europe, the production of moulds also has diminished but in lower intensity. In the picture (table 3) elaborated by Feamm from data of Eurostat, can observe as in the 2010 the descent has been of 7% in relation to the 2009 and of 15% in relation to the 2004. In Spain, for the same periods, the descents have been of the 13 and of 50% Like consequence, Spain has happened to contribute the 4,6 % of the European production in the 2004 to 2,7% of the 2010.

And although it does not have of official data on the production of the 2011 himself that exist estimates in this regard. In the two last meetings of employers of Feamm celebrated in November in Barcelona and in April in Galicia, the majority of participants manifested that the 2011 had been better that the 2010. In the same sense aim the results of a survey to the associated of Ascamm, for 64% of which the turnover of the 2011 had been upper to the one of the 2010. Regarding the forecasts for the 2012, 37% expect that the turnover increase and 45% that keep .

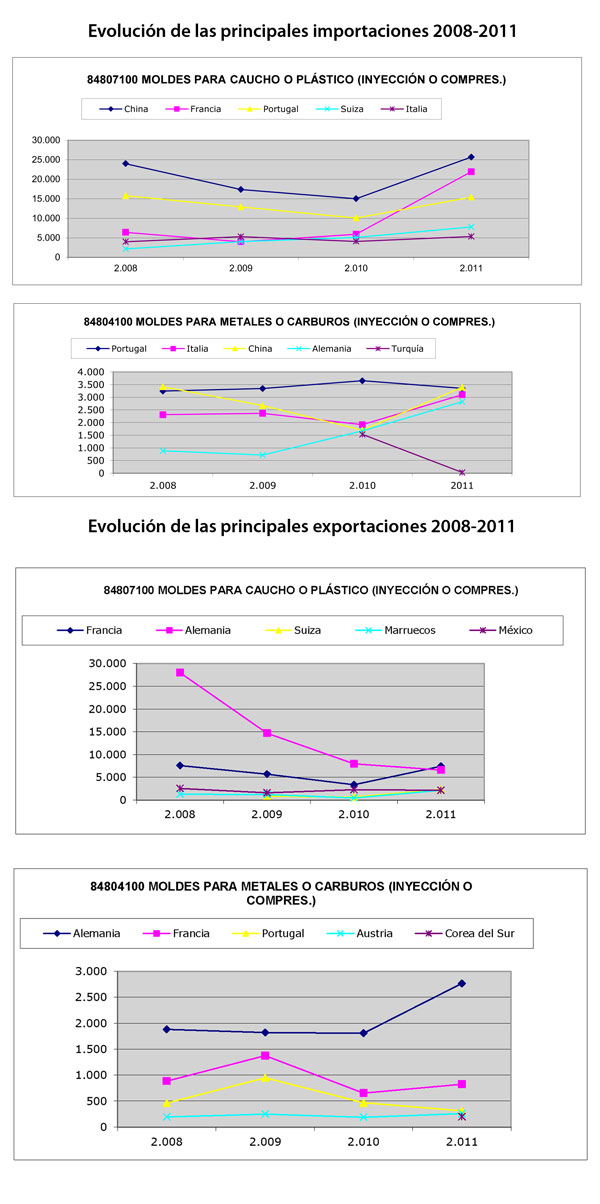

Of the exports and imports of moulds has of figures of the 2011 that show that, both, have increased significantly in relation to the 2010, almost triplicando the imports to the exports for the moulds of injection of plastic. See table 4.

The estimates indicate as that in the 2011 the situation has improved. We trust that the official figures will be in concordance and that the evolution in the 2012 will confirm it.

Some particular cases

Taking again in consideration the opinions of the employers of Feamm, can affirm that from Galicia to Valencia, going through the Basque Country, Navarra, Aragon and Catalonia, there are companies that are crossing a good moment. Good sample of this are the figures of turnover of the 2011, the renewals of machinery, the extensions of productive capacity, the collaborations with countries of low cost and the installation of plants in other countries (Romania, Morocco and Mexico add to the ones of Poland, Czech Republic and Slovakia). Something of this are doing, for quoting only some, companies like Hispamoldes, Matrigalsa, Aurrenak, Ind. Lebario, Irumold, Moulds J. Cherry, Moral Moulds, MYPA, Dicomol, Mole-Matric, C. M. Solé, Migó/Maugo, T. Rogasa, Ind.Ochoa And Mundimold (apologise already from here to all those that would have to be quoted also and that are not it by desconocimiento)

curious Case is the one of Irumold, that has come experiencing the last 4 years a continuous increase of the turnover, allocating more than 95% of his production to the export to the most advanced markets technologically in Europe and EE UU.

Probably this growth in period of crisis was because of a proactiva political of adaptation to the changes of the market before that these produce , together with a priorización of the commercial actions and the reinversión in technical renewal of equipment in addition to a personal implication of the steering.

This is the recipe: anticipation, commercial action and technical renewal.

And since it has gone out the technical renewal, leave proof of the differences that exist between the distinct communities in the deal that dispenses to the companies that want to renew his park of machinery.

Also is true that of the fair and the form to speak of her. The one who this writes has received in a same afternoon two calls of pertinent opposite sign of companies very very prepared of the sector. One to announce the imminent closing and another saying that it has a load of work of eight months and needs to hire personal, will not close by holidays and is working in a plan of investments to increase the automation of his processes of manufacture.

Evolution of the production, trade and consumption of moulds in Spain

The most next surroundings

By a lot of that affect us, a lot of things are out of our scope and others almost. We go to leave the banks.

Nevertheless, the sectorial entities have one some capacity to have a conversation with the Administration and here have to act. All those that have sectorial plans with the Icex have suffered the cuts and those that are to the case of the helps for the plans of competitiveness of the industrial strategic sectors will have observed how, in the recent announcement of this year, has diminished the endowment, in addition to the term to present applications that has happened of 30 to 20 days, whereas the type of interest of the loans has happened of 0 to 3,95%. But still it is a good help.

In the case of the Icex, eleven sectorial entities, between which finds Feamm, have elaborated a statement for the support to the internationalisation that has been remitted to the Office of State of Trade and the Icex has summoned a meeting to finals of June to treat of this subject.

Of other planned performances in the Integral Plan of Industrial Politics (PIN 2020) of the Minetur, as they can be the Plan of Business Growth, neither knows . It would be necessary to go concretising.

Is clear that we have to manage us in some surroundings of restrictions that self-evident in the disappearance of programs or lines of helps for the companies and in a lower endowment to which keep .

Better invest that spend

Fits to suppose that, the same that has happened with the announcement for the strategic sectors, will go concretising the remaining planned performances in the quoted PIN 2020, that follows being in the web of the Minetur. While, the request that have moved to the Minetur and on which will follow insisting is that when, as now, the resources are scarce suits to have very clear the priorities and look for sustainable results to half and long term. It was not that it repeat the Plan And. We do not spend it everything in subsidies for incentivar the purchase of vehicles and better that invest a good part in improving the productive systems that will allow us be more efficient and abaratar the cost of said vehicles and, in consequence, be more competitive. Although there is one some demora in the time, the result will be the same for the final buyer and the positive effects of the investment will persist.

Evolution of the production of plastic moulds in Europe

|

PLASTIC MOULDS* |

||||

|

|

2004 |

2009 |

2010 |

|

|

GERMANY |

1.546 |

1.590 |

1.475 |

|

|

ITALIA |

1.026 |

916 |

841 |

|

|

FRANCE |

633 |

584 |

437 |

|

|

PORTUGAL |

322 |

330 |

305 |

|

|

AUSTRIA |

|

202 |

247 |

|

|

UNITED KINGDOM |

225 |

127 |

124 |

|

|

SPAIN |

214 |

122 |

106 |

|

|

REP. CHECA |

77 |

93 |

106 |

|

|

HOLLAND |

130 |

45 |

62 |

|

|

POLAND |

57 |

42 |

48 |

|

|

OTHER |

369 |

185 |

178 |

|

|

TOTAL |

4.599 |

4.236 |

3.929 |

|

|

*Source: Eurostat |

||||

|

Figures: million € |

||||

Prioritise what can do without money

Recently has finalised a Plan of Improvement of Local Providers of the Sector of Automotive sector coordinated by the association Ascamm and supported by the Catalan administration that has had the participation of Emtisa, Ficosa, Gestamp, Peguform and a veintena of moldistas and matriceros.

The aims were:

- Increase with a plus of competitiveness the advantage that the vicinity awards to the local providers

- Increase the competitiveness and efficiency of the group of companies of a same chain of value improving the communication, the relations and the methods of work between them

The actions carried out to reach them have been:

- Learning and individual advice to the moldistas and matriceros to improve his productivity

- conjoint Meetings between technicians of the companies of the two levels.

Some of the subjects treated in the meetings between technicians were: favour the links to half-long term, flexibility in the application of procedures or fascicles of loads, good management of the times and reasonable terms of manufacture, flexibility in the follow-up of manufacture of the tooling and in the phases that do not depend of the manufacturer of the tooling, punctual collaborations between manufacturers of toolings to access to big requests that can not attend individually, regular collaborations between a stable group of companies to surpass the limitations of his small dimension and can like this attend the needs of his customers.

Tackle any one of the quoted points is more a question of will that of money. In some cases depend on the customers but in others only of us same.

To facilitate a good understanding, have to avoid picaresque and bad practices like the one of some customers of demorar excessively the homologations and, like consequence, the payment of the tooling with the consequent damage and unrest totally avoidable for the moldista.

Has been only a first step but, without any doubt, east is one of the ways to be followed. They can not look for partial solutions. Has to tackle the problem in his whole. The sector of automotive sector are not the manufacturers of vehicles on the one hand, the ones of components and of first level by another and all the other each to the his. We go to see if we achieve to organise us better, coordinatedly, to be more efficient. The Administration and the manufacturers of vehicles are those that have to take the initiative and throw of the rest. The ones of down already will push.

The challenge is not to have competitive companies. The challenge is to have the competitive country and here that each put the border where him plazca. And this, in addition to knowledges and means, requires empathy and collaboration.

The things are very bad and have to encourage us all the parts in facilitating us the respective works. More than of goodness is a question of intelligence. Of a side, adapting the exigencias to the mould or matrix to the real needs or provision of the piece to manufacture and adjusting the payments so that it was not the moldista the one who fund the mould and by the another entering the necessary changes in our form to work to be able to offer more and better products and services to our customers to some competitive prices.

Evolution of the main imports and exports (2008-2011)

Of good figures to good team

The main weak point of the sector is the small dimension of the companies and the scarce degree of collaboration between the same. The easy simile in a country futbolero as ours is that we have of good players, excellent figures even, but have a bad team. And here yes that depend totally of us. Something Is doing and go to continue.

Regarding the matrices, in the period 2001-2010 considered, the production has reduced to the half happening of 371 millions to 188. Here, the most worrisome data is the consumption that has reduced 77% happening of 263 millions to 59, which explains that the exports almost cuadripliquen to the imports.

The production of matrices in Europe has reduced a third in the period 2004-2010 happening of 3.624 million euros to 2.455. To observe that Germany has won quota of market happening of the 51 to 61%, that Italy keeps it and France and Spain diminish it considerably happening, in the case of Spain, of the 12,8 to 7,5%

On the other hand, also have increased the exports and imports of matrices that with 189 and 76 millions have reached figures almost record. See table 4. To stand out the 8 already exported to Morocco and that South Korea has been, with difference, our first provider.