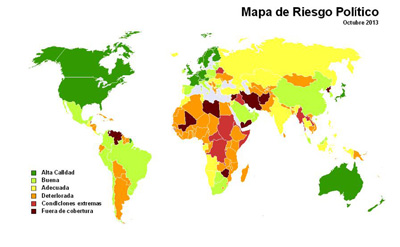

Credit and Caución foresees that the recovery accelerate in 2014

22 November 2013

In accordance with the last Economic Outlook spread by

Austria and Germany will be the motors of this European growth, with taxles in the surroundings of 1,8%. Greece will be the only market of the zone euro clearly in contraction in 2014 while Spain, Portugal, Italy and Low Countries, that have retreated in 2013, could change of sign in 2014, although with levels still very low of growth.

In front of the good evolution of the markets advanced, the growth expected in the emergent markets will follow moderating, although it will keep relatively firm. China and India will have difficult to keep his vertiginous rhythms of the last years, but the group of the sudeste Asian will grow 6,3% in 2014. Softer will be the evolution of Latin America, 3,3%, and east Europe, 3,1%. The evolution of the emergent is marked by the exit of capitals, especially intense in markets like Turkey and Brazil. Nevertheless, the emergent have improved his financial situation in the last decade and would have to be able to resist monetary conditions more restrictivas.

In these surroundings of economic growth, also foresees an acceleration of the world-wide trade until 4,5%, a noticeably upper tax to 1,9% of 2012 and 2013. According to the report spread by Credit and Caución, Spain and Portugal are in very good position to take advantage of this increase of the international commercial activity. The Iberian market has registered a historical evolution of his exports along the last three years and half of crisis, with a growth accumulated of 24% in Portugal and 23% in Spain. This evolution is fruit, mainly, of the improvement of the competitiveness through adjust salariales. These two countries show the greater reduction accumulated of the unitary labour costs of the eurozone in the last three years and half, that also is significant in Ireland and Italy. Germany shows a reduction marginal, while Low Countries and Belgium have lost competitiveness salarial.

On line with this improvement of the economic conditions, the surroundings of business insolvency also will improve in 2014 of global form, after a 2013 marked by the impairment in a lot of countries. Credit and Caución expects that this mejoría was especially intense in United States, United Kingdom and the Nordic countries. In the zone euro, the insolvencies tend to stabilise . The planned growth for 2014 is of only 0,9% in front of 6,8% registered in 2013. In the peripheral countries, like Spain, the insolvencies will grow near of 2,5% after surpassing 11% in 2013.