Aspromec and Confemetal carried out a study of competitiveness of machining in Spain

April 18, 2011

The aim is to do a study that remove the light degree of competitiveness of the industrial sector of machining on Spain and its impact on the competitiveness of the large companies that subcontract machining work locally as well as in ancillary sectors to machining. The conclusions of this study will dispose the actions that should be undertaken on several fronts to improve the competitiveness of this industry in Spain.

This article seeks to explain the scope of this study and the objectives is seeking with its realization.

Need for the study

The Biscayan Federation of Metal businessmen (FVEM) describes as a 'hidden sector' machining sector. Not without reason. In fact, an SME who engages in machining parts for customers don't have very easy to find a code that represents your activity.

Since Aspromec we define the beneficiaries of our activities, the 'SMEs of machining', as those companies that incorporate the technology of manufacture of the machining processes. Of course, that this definition fit both those SMEs involved in 'pure' form to the machining and companies using the machining as a technology for the manufacture of its products. The first are not recognized sectorally and the latter are within the sector: identifying their products.

The same applies to other metal processing technologies such as welding or deformation.

However, from within the sector the distinction of an SME in the tooling is very clear; Another thing is that the standard organization of sectors of activity does not recognise the activity of the machining as such.

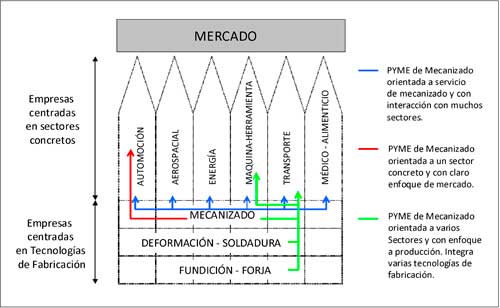

In the study of competitiveness shall be distinguished three types of SME of machining that give rise to cuatro groups strategic. They are described in the following way:

(i) SMEs of machining that provide a service of machining to many industrial sectors. They are outsourcing SMEs are not market-oriented. Its development depends on demand from their customers, usually near companies that give them machining work to incorporate in their products. This group is distinguished in Figure 1 with the color blue.

(ii) the SMEs of machining that they work for two or three different sectors and which are integrated down than previous ones, i.e., that they offer to their customers not only machined parts and components. They incorporate more manufacturing and even occasionally something of engineering technologies. This type of SME of machining offers more value added to their product than the previous group, but its approach to the market is not high, remains dependent on customers who tend to be large companies operating in specific sectors such as Airbus or Alstom. In Figure 2, this strategic group is distinguished with green color.

(iii) Finally, the SMEs of machining that more specialized are in a sector. Normally manufacture a product with a high content of machining. His approach to the market is much higher than the previous two. This type of machining SME gives rise to two strategic groups depending on their degree of vertical integration, i.e. of the approach to the market that have. This type of SMEs exists in all sectors, still very common in the automotive sector in the manufacture of automotive parts with high percentage of machining in manufacture. More market-oriented companies will be those that manufacture products with a level of greater finish, which go directly to the user or to an assembly line. These companies are represented in red in Figure 1.

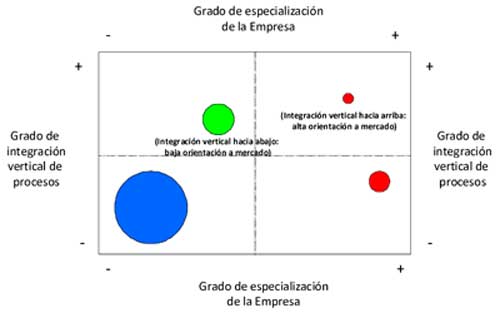

The four strategic groups in which we can classify the sector can also be represented in Figure 2. In this case, the size of the circles is proportional to the number of companies in each group.

As you can see, the blue circle represents the largest group, which is made up of troop under value added by their low vertical integration and companies that are also poorly specialized and bit-oriented market. This is a problem for the competitiveness of the sector because there are many little differentiated companies and with few possibilities of acting on the market, that simply are waiting for their local clients are demanding activity.

The green circle represents a very interesting group of companies from a productive point of view and value-added, but perhaps not gaining much profitability due to its lack of interaction with the market, with the final customer.

Finally, the red dots are companies with a higher degree of specialisation, but among them are the most integrated into commercial activities and those simply engaged in manufacture well with a high degree of specialization.

The four strategic groups are necessary for the proper functioning of the sector, which may not be well balanced is that distribution of the number of companies in each group, especially in our country, where the number of companies driven is low and their tractor on the sector, insufficient effect. In a condition of such demand, a priori may think that some companies should move towards the strategic group of red color, with greater focus to the market.

The study dimensionará each strategic group and will reveal the competitive factors of each as well as the possibilities of development of business of each strategic group companies to be competitive in our environment.

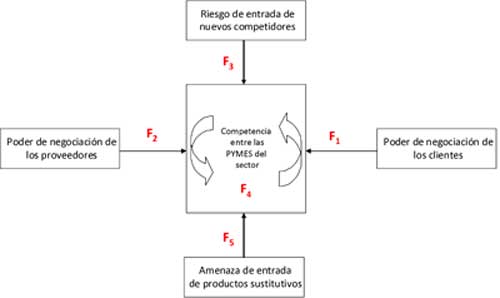

Another preliminary analysis of the competitiveness of the SMEs of machining, with data at our disposal a priori is that is based on the theories on competitiveness of Michael e. Porter. It argues that the intensity of competition in an industry is conditioned by five forces:

F1. The bargaining power of customers, in the case of SMEs in machining is very intense because they usually work for much larger than these companies.

F2. The bargaining power of suppliers, which is also an intense force because the of machine-tool, energy suppliers or funding they tend to be large multinational.

F3. The risk of entry of new competitors. This force was weak as enterprises tractors contracted locally machining for convenience of proximity, but new technologies and the trend towards a market much more globalised it is prompting many companies to subcontract out your environment and therefore the strength of this force is growing exponentially.

F4. The rivalry between companies in the sector, which is a force very intense especially in times of falling of demand as that we have experienced recently and finally

F5. The force which measures the likelihood of entry of alternative manufacturing technology to machining as the laser or the closest to the final profile forge. The latter is perhaps the least worrying compared to the other four, but it ceases to be intense.

Before these analyses clearly that it is very necessary to make a study of competitiveness of the sector in the tooling in support of actions to be taken from within and outside the sector. The preliminary analysis shows an industry low attractiveness to attract new investment due to the intensity of the competition and with a structure descompensada in the distribution of the SMEs in strategic groups.

A very fragmented sector with opportunities

It is estimated that there are around 10,000 companies within this sector in all Spain and that the average billing round around one million Euros and that 97% of the companies are SMEs or micro. It is therefore a very fragmented and too small enterprise sector.

Before these features presents many opportunities, and most of them in the consolidation of the sector. Consolidation to come motivated by the growth of the companies in the sector, by the emergence of business groups on stage or through cooperation among SMEs of machining and other ancillary areas.

Structure of the 'competitiveness study'

This study proposes four lines of action based on the following objectives:

(i) structural analysis of the sector and characteristics of SMEs in the tooling in Spain.It is intended to identify the key parameters of the sector, from a quantitative and qualitative point of view to identify the needs of the companies that compose it.

(ii) analysis of the demand.

In order to identify the needs of companies outsourcing tractors, the degree of satisfaction when they subcontract machining locally and outsourcing trends. A basic analysis of the demand from international markets should also be included in order to identify opportunities for access to other markets.(iii) evaluation of the factors relating to the infrastructure for the competitiveness of the sector.

In order to identify shortcomings in the level of training of entrepreneurs, managers and employees of SMEs in the tooling, the degree of communication and technology transfer with the technological centres and universities, access to physical infrastructure at reasonable cost, in access to aid for internationalisation, innovation or investment and access to financing at a reasonable cost.(iv) assessment of the degree of competitiveness of the auxiliary and related sectors.

In order to assess the bargaining power with suppliers and possible actions for cooperation among SMEs in the tooling to benefit from economies of scale. Also identify opportunities for cooperation with complementary sectors to assist SMEs in the tooling to integrate technologies that expand the value added to the client as well as access to international markets.

Dates of implementation

The study of competitiveness will be held between April and November of 2011.

Benefits for SMEs of the machining

The benefits of the study are many, and although it is true that they depend on the degree of interest from the employer in the implementation of the conclusions, we hope to benefit the sector as follows:

- Generation of a key to facilitate text taking strategic decisions to the entrepreneur or Director of the SMEs in machining.

- This type of company to locate in a given sector of activity and define the characteristics of the same so that the SMEs of the machining can compare their strategies, activities and results with the sector.

- Offer to SMEs in the tooling visibility over their competitors, especially on those coming from other countries (unknown).

- Raise awareness of SMEs in the sector on the threats to their survival posed by the fact of having a size recommended below, mark the appropriate strategies to grow via cooperation or integration, or where appropriate the strategies of survival for the micro.

- Assist SMEs in the sector to identify the needs of its customers at the present time, serving as a bridge between the large local companies (customers) need of SMEs and that SMEs can offer.

- Offer a relationship of business opportunities in other countries, identifying trends in outsourcing and higher value-added markets.

- Identify shortcomings in training managers of SMEs in the sector and its employees.

- Identify opportunities for innovation among SMEs in the sector that are lost due to lack of information on State aid.

- Identify opportunities for internationalization between SMEs in the sector that are lost due to lack of information about the support offered by the public administration.

- Raise awareness of SMEs on the importance of making technology watch in its market and so have the communication adequate with the network of universities and technological centres existing. That communication becomes a motivation to the r & d in SMEs in the sector.

- Identify opportunities on aid to investment in equipment or technology to increase the productivity of the SMEs in the sector.

- Gather the opinion of the associations of provincial Metal on the proactivity of entrepreneurs in the sector in harnessing support to the competitiveness of their enterprises and disseminate that opinion about entrepreneurs to make them aware of the degree of use of such aid.

- Disclose cooperation opportunities of SMEs in the sector with SMEs of ancillary sectors in order to increase their competitiveness in international markets or markets for higher added value.

- Disclose opportunities for cooperation between SMEs sector in order to take advantage of economies of scale and increase the strength of bargaining with its suppliers own.

In short, create a text to post it to the entrepreneurs and managers of SMEs in the sector that will enable them to acquire knowledge sobre as:

- Make their firms more competitive.

- Chart a strategy of growth through cooperation or integration of manufacturing technologies.

- Access to international markets.

- Enter into the dynamics of innovation.

- Change certain habits or cultural aspects that make them lose opportunities for their companies.

Conclusion

The Ministry of industry, through Confemetal, and the activities of the Observatory of the Metal, has given us the opportunity to bring to light the features and shortcomings in our sector in terms of competitiveness. Opportunity that we will and hope that it will serve to all employers with an SME of machining as a tool of inspiration to improve the competitiveness of their enterprises.