Principales datos de la actividad de I+D+i en España y su financiación

Alma CG, consultora destacada en la optimización de costes a través de la fiscalidad, ha analizado en detalle los datos correspondientes a nuestro país recogidos en la 8ª Edición del Barómetro internacional de financiación de la Innovación 2012, que elabora y hace públicos de forma anual. El Barómetro contempla el análisis de 4.320 empresas innovadoras de 10 países (Alemania, Bélgica, España, Francia, Hungría, Polonia, Portugal, Reino Unido, República Checa y Canadá), de tamaños diversos y de sectores como: alma y media tecnología (Telecomunicaciones 16%, Energía/Medioambiente 15%, Ingeniería 10%, Electrónica 8% y Farmacéutico 8%) y servicios. Francisco Marín, patrono de la Fundación Cotec y representante por España del Comité de Expertos que han interpretado los datos arrojados por la encuesta, junto con Juan Mulet, director general de Cotec, han contribuido en la valoración de los datos de la actividad de I+D+i en España.

Las 11.178 empresas españolas con actividad de I+D realizaron un gasto total de 7.396.369 (K ) (Ine 2011), cifra totalmente insuficiente para ser competitivos frente a los países de nuestro entorno y a nivel internacional. Si bien España es un país innovador moderado, las modificaciones realizadas en 2011 y 2012 de la estructura del sistema de financiación de la innovación, han afectado de pleno a las empresas con actividad innovadora. Estas son algunas de las conclusiones apuntadas por Cotec.

Además, la financiación de la innovación de las empresas españolas ha disminuido durante el pasado año en mayor medida que en otros países (34% en España frente al 22% de media en el resto de países). El dato recogido en el Barómetro es alarmante, máxime si tenemos en cuenta que para la mayoría de las empresas innovadoras encuestadas, su nivel de financiación se mantiene estable (44,6%), e incluso está creciendo (33,6%).

Si profundizamos en el análisis de los datos del Barómetro, vemos que también existe distancia en cuanto a los valores de las prioridades estratégicas de las empresas. Para el 24% de las españolas, la prioridad es la innovación, frente al 37% del resto de encuestadas, seguido de la reducción de costes globales (18% para las españolas frente al 12%), y en tercer lugar el desarrollo internacional (13% para las españolas frente al 12%).

Existe sin embargo unanimidad en cómo están financiando el I+D: en mayor cuantía con fondos propios (el 57% de las españolas frente al 53% del resto de países), seguido de fondos públicos (el 25% de las españolas frente al 55% del resto de países). Ahora bien, el impacto de la financiación externa en las empresas españolas ha sido menor que en el resto de países: El 27% de las empresas españolas aumentó el volumen de negocio en nuevas ofertas frente al 59% en el resto de países; el 19% de las españolas aumentó el número de innovaciones que llegan al mercado, frente al 60% en el resto de países; el 18% aumentó el trabajo de I+D, frente al 40% en el resto de países, y un 20% aumentó los acuerdos para la I+D.

En cuanto al principal recurso externo utilizado para financiar la I+D, las empresas españolas coinciden con las del resto de países encuestados: las deducciones fiscales. El 58% de todos los encuestados las utilizan y el 18% se ha deducido por primera vez. En España, el 55% de las empresas encuestadas las utilizan. Los obstáculos para su mayor uso son también parecidos en todos los países encuestados: actividades no deducibles (25% en España y 28% en el resto de países); falta de conocimiento sobre el mecanismo (18% en España versus 15%) y la complejidad del mecanismo (17% en todos los países encuestados).

Las deducciones fiscales juegan pues un papel muy importante en el mundo empresarial actual: como ayuda para mejorar la tesorería (el 45% de los encuestados en España y Canadá) y para el mantenimiento del empleo (el 20% de los encuestados españoles y checos), de ahí que exista cierta preocupación ante su posible eliminación, ya que sin duda alguna es una herramienta de atracción territorial.

En este sentido, el gobierno español ha dado un paso más en el apoyo a la competitividad del tejido empresarial español, al activar mecanismos como el cash back y prevé la reintroducción del sistema de bonificaciones en las cuotas a la Seguridad Social de trabajadores dedicados en exclusiva al I+D+i. Estas modificaciones fiscales nos situarían en mejor posición para atraer inversión extranjera directa (IED). El cambio de modelo productivo que necesita España requiere de la participación de empresas intensivas en tecnología y en I+D+i desarrollada en España, así como políticas de fiscalidad de la I+D+i que favorezcan la atracción de estas empresas.

A pesar de las limitaciones existentes en el sistema fiscal español de apoyo a la I+D+i, para conseguir maximizar el retorno fiscal generado, las empresas pueden introducir variables de tipo fiscal en la toma de decisión sobre la planificación de sus actividades de I+D+i. En el retorno fiscal han de tenerse en cuenta tres variables: la elegibilidad del tipo de actividad y gasto, la intensidad de la inversión en I+D y la temporalidad entendida como distribución en el tiempo de ese ahorro. Esta última variable cobra relevancia porque el efecto que tiene un incentivo es directamente proporcional a la inmediatez de la recompensa. Es decir, minimizar el tiempo que transcurre desde que se realiza la inversión y el ahorro que genera. En este contexto, hay que tener en cuenta tres elementos clave:

- La configuración de los pagos fraccionados (deducciones fiscales por I+D+i y la reducción de ingresos por cesión de intangibles-Patent Box).

- El momento de liquidación de la cuota diferencial.

- La posibilidad de restitución de los créditos fiscales generados (cash back).

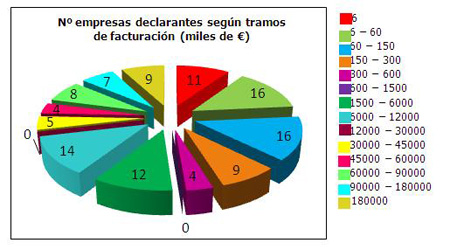

Analizando algunos datos sobre el retorno fiscal, llama la atención que según la Estadística de la Aeat correspondiente al ejercicio fiscal 2010, tan sólo 121 empresas han aplicado el Patent Box, de las que alrededor del 60% son grandes grupos, generando un ahorro fiscal de más de 74 millones de euros. Si bien el Patent Box se introdujo en España en 2008, su porcentaje de penetración es aún mínimo, y por tanto, el potencial de desarrollo que tiene por delante es muy prometedor.

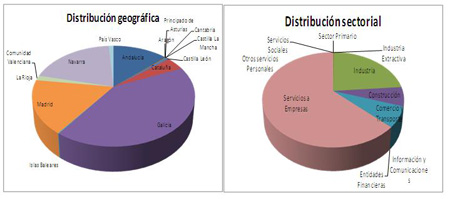

Concentación geográfica y sectorial utilización Patent Box en España.

En la misma estadística y por este orden: Galicia, Madrid, Navarra y Andalucía son las áreas geográficas que destacan en la utilización del Patent Box, y los sectores más activos son: Servicios e Industria.

Impacto de la futura Ley de Emprendedores en la I+D+i

Uno de los puntos incluidos en el Anteproyecto de Ley de Emprendedores, es la modificación de los incentivos fiscales ligados al Patent Box. Actualmente este incentivo permite la reducción en la base imponible del Impuesto sobre Sociedades del 50% de los ingresos obtenidos por la cesión a terceros del derecho de uso o explotación de patentes, dibujos o modelos, planos, fórmulas o procedimientos secretos, cesión de derechos sobre informaciones relativas a experiencias industriales, comerciales o científicas.

La novedad que introduce la futura Ley de Emprendedores es que la reducción podrá aplicarse no sobre el 50% de los ingresos obtenidos, sino de los beneficios que originen, y se incrementa el porcentaje de reducción al 60%. Se aplicará, por tanto, sobre la renta neta y no sobre la bruta que origine esos derechos de cesión o explotación. Asimismo se podrá aplicar esta deducción no sólo para los activos creados por la empresa, sino también para los adquiridos a terceros. En estos casos el bien ha de permanecer al menos dos años en la empresa y el porcentaje de reducción a aplicar será del 40%.

También hay cambios en cuanto a los límites de su aplicación. Ahora sólo puede aplicarse hasta el ejercicio fiscal en el que los ingresos acumulados derivados de dicha cesión multipliquen por 6 el coste de generación del activo. Con la nueva Ley la aplicación del incentivo no tendrá límite alguno. Estos aspectos están ya en vigor en otros países de la UE y suponen un importante apoyo a la actividad innovadora en las empresas españolas, mejorando su competitividad al equipararse las condiciones de aplicación a los de países extranjeros.